As Crypto Market Platforms You Shouldn’t Ignore in 2025 takes center stage, this opening passage beckons readers into a world crafted with good knowledge, ensuring a reading experience that is both absorbing and distinctly original.

The world of cryptocurrency platforms is evolving rapidly, with new players entering the market and innovative features shaping the landscape. In this guide, we explore the key aspects of these platforms and why they are essential in the financial market of 2025.

Overview of Crypto Market Platforms

Cryptocurrency platforms play a crucial role in the digital economy, providing a marketplace for buying, selling, and trading various cryptocurrencies. These platforms serve as the backbone of the crypto market, facilitating transactions and enabling users to engage in the world of digital assets.

Current Landscape of Crypto Market Platforms

- Leading platforms such as Coinbase, Binance, and Kraken dominate the market, offering a wide range of services to crypto enthusiasts worldwide.

- New decentralized platforms like Uniswap and Sushiswap are gaining popularity, providing users with more control over their assets.

- Specialized platforms focusing on specific aspects of the crypto market, such as lending or derivatives trading, are also emerging to cater to the diverse needs of investors.

Significance of Crypto Market Platforms

- Crypto platforms serve as the gateway for individuals to enter the digital asset space, democratizing access to financial opportunities.

- They contribute to the liquidity and price discovery of cryptocurrencies, creating a more efficient market for participants.

- By offering a range of services, these platforms help users manage their portfolios, execute trades, and explore new investment opportunities in the crypto space.

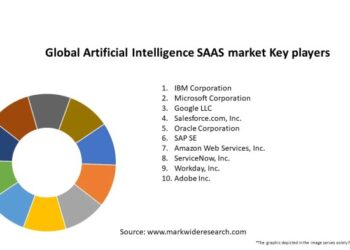

Key Players in the Crypto Market Platform Industry

- Coinbase:One of the largest cryptocurrency exchanges in the world, known for its user-friendly interface and strong security measures.

- Binance:A global crypto exchange offering a wide range of trading pairs and innovative products like Binance Smart Chain.

- Kraken:A US-based exchange with a strong reputation for security and compliance, catering to both retail and institutional investors.

Emerging Platforms in 2025

As the crypto market continues to evolve, new platforms are constantly emerging to offer innovative features and technologies to users. These platforms are poised to disrupt the industry and compete with existing ones in terms of growth potential.

Decentralized Finance (DeFi) Platforms

Decentralized Finance (DeFi) platforms are gaining momentum in 2025, offering users the ability to access financial services without traditional intermediaries. These platforms utilize smart contracts and blockchain technology to facilitate various financial activities such as lending, borrowing, and trading.

- Platforms like Aave and Compound are leading the way in the DeFi space, allowing users to earn interest on their crypto holdings and participate in decentralized governance.

- The growth potential of DeFi platforms lies in their ability to provide financial services to underserved populations and offer more transparent and efficient alternatives to traditional finance.

- With the increasing popularity of DeFi, these platforms are expected to continue expanding and attracting more users in the coming years.

NFT Marketplaces

Non-Fungible Token (NFT) marketplaces are also on the rise in 2025, allowing users to buy, sell, and trade unique digital assets on the blockchain. These platforms have gained attention for their ability to tokenize digital art, collectibles, and other unique items.

- Platforms like OpenSea and Rarible have become popular choices for NFT enthusiasts, offering a wide range of digital assets for sale.

- NFT marketplaces are revolutionizing the concept of ownership in the digital age, allowing creators to monetize their work and collectors to own exclusive digital assets.

- The growth potential of NFT marketplaces lies in their ability to create new revenue streams for artists and creators, as well as provide a decentralized and secure platform for buying and selling digital assets.

User Experience and Interface

In the world of crypto market platforms, user experience and interface design play a crucial role in attracting and retaining traders and investors. Let's delve into how popular platforms are faring in terms of user satisfaction and interface usability.

User Experience of Popular Platforms

When it comes to user experience, platforms like Binance, Coinbase, and Kraken are leading the pack. These platforms offer intuitive user interfaces, seamless navigation, and a wide range of features that cater to both beginners and experienced traders. They also provide responsive customer support to address any issues users may encounter.

Interface Design and Usability

- Binance: Known for its clean and user-friendly interface, Binance offers a customizable trading dashboard that allows users to personalize their trading experience. The platform also provides advanced trading tools for more experienced traders.

- Coinbase: With its simple and easy-to-navigate interface, Coinbase is a popular choice for beginners. The platform offers a mobile app for convenient trading on the go and ensures a smooth onboarding process for new users.

- Kraken: Kraken boasts a professional interface design with a focus on security and performance. The platform offers a wide range of trading pairs and advanced charting tools for technical analysis.

User Feedback and Platform Improvements

User feedback plays a critical role in shaping the development of crypto market platforms

Security Measures

Cybersecurity is a top priority for leading crypto market platforms to ensure the safety of user data and assets. These platforms implement a variety of security protocols to protect against potential threats and attacks.

Multi-factor Authentication

- Many platforms require users to enable multi-factor authentication (MFA) to add an extra layer of security to their accounts.

- MFA typically involves a combination of passwords, biometrics, or security tokens to verify the user's identity.

Cold Storage for Funds

- Leading platforms often use cold storage solutions to store the majority of user funds offline, away from potential online threats.

- This practice helps protect against hacking attempts and unauthorized access to funds.

Regular Security Audits

- Platforms conduct regular security audits to identify and address any vulnerabilities in their systems.

- External security experts are often hired to perform these audits to ensure thorough testing of the platform's defenses.

End-to-End Encryption

- Many crypto market platforms employ end-to-end encryption to secure user communications and transactions.

- This encryption method ensures that data is only accessible to the sender and intended recipient, protecting it from interception.

Market Liquidity and Trading Volumes

In the world of cryptocurrency trading, market liquidity and trading volumes play a crucial role in determining the success and popularity of a platform. Liquidity refers to the ease with which an asset can be bought or sold without causing significant price changes, while trading volumes indicate the amount of assets being traded within a specific period.

Market Liquidity Levels

Market liquidity levels vary across different crypto market platforms, with some exchanges having higher liquidity than others. Platforms with high liquidity tend to attract more traders and investors due to the ability to execute trades quickly and at competitive prices.

These platforms also experience less price slippage, which is the difference between the expected price of a trade and the actual price at which it is executed.

Trading Volumes and Price Movements

Trading volumes have a direct impact on price movements in the cryptocurrency market. Higher trading volumes often lead to increased price volatility, as large buy or sell orders can cause significant price swings. Platforms with high trading volumes are usually more liquid and offer better opportunities for traders to enter and exit positions without facing price manipulation.

Role of Market Liquidity in Platform Popularity

Market liquidity plays a significant role in determining the popularity of a crypto market platform. Traders and investors are more likely to choose platforms with high liquidity levels as they provide better trading opportunities, tighter bid-ask spreads, and increased price stability.

Platforms with low liquidity may struggle to attract users and could face challenges in maintaining a competitive edge in the market.

Regulatory Compliance

Cryptocurrency market platforms must adhere to regulatory frameworks to ensure transparency, security, and trust among users. Regulatory compliance plays a crucial role in establishing credibility and protecting investors from fraudulent activities.

Global Regulatory Landscape

- Platforms in the United States, such as Coinbase and Gemini, operate under strict regulations enforced by the SEC and FinCEN to prevent money laundering and fraud.

- In Europe, platforms like Bitstamp and Kraken comply with the Anti-Money Laundering Directive (AMLD5) and adhere to the guidelines set by the European Securities and Markets Authority (ESMA).

- In Asia, exchanges like Binance and Huobi face regulatory challenges due to varying regulations in countries like China, Japan, and South Korea, leading to uncertainties in compliance requirements.

Importance of Regulatory Compliance

- Regulatory compliance ensures the protection of user funds and data, fostering trust and confidence in the platform.

- Compliance with regulations helps in preventing illicit activities such as money laundering, terrorist financing, and fraud, safeguarding the integrity of the market.

- Platforms that prioritize regulatory compliance are more likely to attract institutional investors and larger market participants, contributing to market stability and liquidity.

Wrap-Up

In conclusion, Crypto Market Platforms You Shouldn’t Ignore in 2025 offer a glimpse into the future of finance. With enhanced user experiences, robust security measures, and a focus on regulatory compliance, these platforms are poised to revolutionize the way we engage with digital assets.

Stay ahead of the curve and explore these platforms to unlock new opportunities in the crypto market.

Common Queries

What sets emerging platforms apart from existing ones?

Emerging platforms in 2025 often introduce cutting-edge technologies and features that address current market demands, setting them apart from established players.

How do crypto market platforms ensure user data security?

Leading platforms implement advanced security protocols like encryption and multi-factor authentication to safeguard user data and assets from potential threats.

Why is regulatory compliance important for crypto market platforms?

Regulatory compliance is crucial for building trust among users and ensuring the legitimacy of platforms. It also helps in mitigating legal risks and fostering a secure environment for trading.