As Platform Reviews: Which One Offers the Best Market Data? takes center stage, this opening passage beckons readers into a world crafted with good knowledge, ensuring a reading experience that is both absorbing and distinctly original.

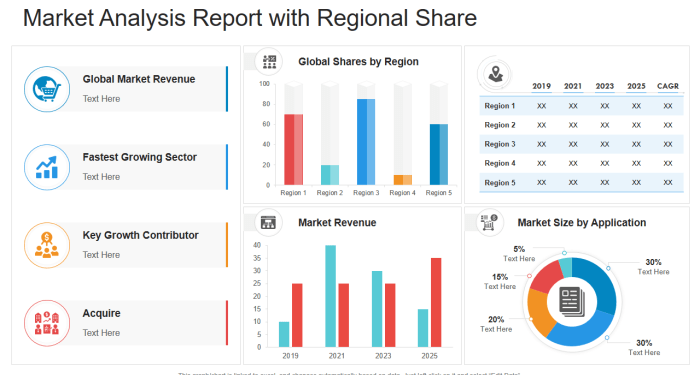

Exploring the various types of market data platforms, their data accuracy, user interface, real-time updates, customization options, and more will shed light on the best options available in the market.

Types of Market Data Platforms

Market data platforms come in various forms, each offering unique features tailored to different needs in the financial industry. These platforms serve as the foundation for traders, analysts, and investors to make informed decisions based on real-time data and insights.

1. Financial News Platforms

Financial news platforms focus on delivering market news, analysis, and commentary to keep users updated on the latest trends and events affecting the markets. Examples include Bloomberg, CNBC, and Reuters.

2. Market Data Aggregators

Market data aggregators compile and present data from multiple sources in a single interface, allowing users to access a wide range of information conveniently. Platforms like Quandl, Alpha Vantage, and Xignite fall into this category.

3. Trading Platforms

Trading platforms not only facilitate the buying and selling of financial instruments but also provide real-time market data, charts, and indicators to support trading strategies. Popular examples include MetaTrader, Thinkorswim, and TradingView.

4. Financial Analytics Platforms

Financial analytics platforms offer advanced tools for data analysis, visualization, and modeling to help users gain deeper insights into market trends and patterns. Platforms like Tableau, Power BI, and SAS Analytics cater to this need.

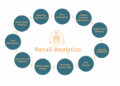

5. Market Research Platforms

Market research platforms provide comprehensive reports, forecasts, and industry insights to assist users in making well-informed decisions. Examples include MarketWatch, FactSet, and Morningstar.

6. Social Trading Platforms

Social trading platforms combine market data with social networking features, enabling users to follow and copy the trades of experienced traders. Platforms such as eToro, ZuluTrade, and NAGA offer this unique approach to investing.

Data Accuracy and Reliability

Data accuracy is crucial in market data platforms as traders and investors rely heavily on the information provided to make informed decisions. Inaccurate data can lead to costly mistakes and missed opportunities in the market. Therefore, ensuring the reliability of data is paramount for these platforms.

Importance of Data Accuracy

Accurate data is essential for traders to analyze market trends, identify profitable opportunities, and manage risks effectively. Any discrepancies or errors in the data can result in incorrect analysis and decision-making, leading to financial losses.

Platform Methods for Ensuring Data Reliability

- Regular Data Updates: Platforms that provide real-time data updates ensure that users have access to the most current information for making trading decisions.

- Data Verification Processes: Some platforms have strict procedures in place to verify the accuracy of the data before it is disseminated to users, reducing the chances of errors.

- Quality Control Measures: Implementing quality control measures such as data validation checks and audits help maintain the reliability of the data provided on the platform.

Impact of Data Accuracy on Trading Decisions

One notable example of data accuracy impacting trading decisions is when a platform incorrectly displayed stock prices, leading traders to make buy or sell decisions based on inaccurate information. This resulted in significant financial losses for those who acted on the incorrect data

User Interface and Experience

User-friendly interfaces play a crucial role in market data platforms by enhancing the overall user experience. A well-designed interface can make it easier for users to navigate the platform, access relevant data quickly, and analyze information effectively.

Significance of Intuitive Design

Intuitive design in market data platforms can significantly improve user experience by simplifying complex data sets and presenting information in a clear and organized manner. Features such as customizable dashboards, interactive charts, and user-friendly navigation menus contribute to a seamless user interface.

- Customizable Dashboards: Allow users to personalize their workspace by selecting the most relevant data points and arranging them according to their preferences.

- Interactive Charts: Enable users to visualize market trends, compare data sets, and identify patterns easily through dynamic and responsive charting tools.

- User-Friendly Navigation Menus: Streamline the user experience by providing intuitive navigation menus that make it simple to access different sections of the platform and switch between data sets efficiently.

Real-Time Data Updates

Real-time data updates are crucial for traders and investors as they provide the most up-to-date information on market movements, trends, and prices. This real-time data allows for quick decision-making, timely executions of trades, and the ability to react to news and events as they happen.

Platform Comparison

- Platform A: Platform A offers real-time data updates through direct feeds from exchanges, ensuring minimal latency and accurate information. Traders can rely on this platform for timely data to make informed decisions.

- Platform B: Platform B integrates real-time data through third-party providers, which may introduce delays and potential inaccuracies. While still valuable, traders need to consider the slight lag in data compared to Platform A.

Importance of Real-Time Data

One scenario where real-time data is critical is during volatile market conditions. For example, a sudden news announcement can cause prices to fluctuate rapidly. Traders relying on real-time data can react quickly to capitalize on opportunities or minimize losses.

Customization and Personalization Options

Customization features play a crucial role in market data platforms as they allow users to tailor their data views according to their specific needs and preferences.

Users can personalize their data views by selecting the type of information they want to see, adjusting the layout of the dashboard, setting up alerts for specific events, and choosing the format in which data is presented.

Benefits of Tailored Data Views

- Investors can create personalized watchlists to track their favorite stocks, currencies, or commodities, making it easier to monitor their performance.

- Traders can customize charts and graphs to display the data points that are most relevant to their trading strategies, helping them make more informed decisions.

- Analysts can set up custom filters to focus on specific market segments or industries, allowing them to conduct in-depth research more efficiently.

Final Conclusion

In conclusion, the quest for the best market data platform is a crucial decision for traders and investors. By analyzing key features and understanding the importance of data accuracy, user experience, and real-time updates, one can make an informed choice that aligns with their trading goals.

Stay informed, stay profitable.

Popular Questions

How do market data platforms ensure data accuracy?

Market data platforms use advanced algorithms and data validation processes to ensure data accuracy, minimizing errors and providing reliable information for traders.

Why is real-time data crucial for decision-making?

Real-time data provides traders with up-to-the-minute information on market movements, allowing for quick decision-making and timely execution of trades to capitalize on opportunities.

Can users personalize their data views on market data platforms?

Yes, many platforms offer customization options that allow users to tailor their data views according to their preferences, making it easier to analyze information and make informed decisions.