Embark on a journey through the realm of real-time financial data tracking with a focus on the top platforms that revolutionize data monitoring. Delve into the intricate world of financial analysis and decision-making as we explore the key features and benefits offered by these cutting-edge tools.

Overview of Real-Time Financial Data Tracking Platforms

Real-time financial data tracking involves monitoring and analyzing financial information as it is updated instantaneously. This allows businesses to have up-to-the-minute insights into their financial health and performance.Utilizing platforms for real-time data tracking is crucial for businesses to make informed decisions quickly.

By having access to real-time financial data, organizations can react promptly to market changes, identify trends, and adjust their strategies accordingly.

Importance of Real-Time Financial Data Tracking

Real-time financial data tracking platforms offer numerous benefits for businesses:

- Immediate Insights: Businesses can access real-time data on their financial performance, enabling quick decision-making based on accurate information.

- Market Monitoring: Companies can track market trends, stock prices, and currency fluctuations in real-time, allowing them to capitalize on opportunities and mitigate risks.

- Performance Evaluation: Real-time data tracking helps businesses evaluate their performance metrics instantly, enabling them to make adjustments to achieve their financial goals.

- Competitive Advantage: By leveraging real-time financial data, organizations can stay ahead of competitors by being proactive and responsive to market changes.

Top Features to Look for in Financial Data Tracking Platforms

When it comes to choosing a financial data tracking platform, there are several key features that you should consider to ensure you are getting the most out of your data analysis and decision-making process.

Real-Time Data Updates

- One of the most crucial features to look for is real-time data updates, allowing you to access the most current information instantly.

- Platforms that offer real-time data updates enable you to make timely decisions based on the most up-to-date market conditions.

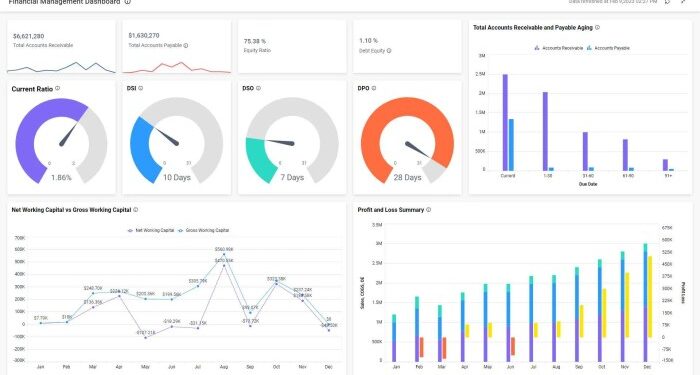

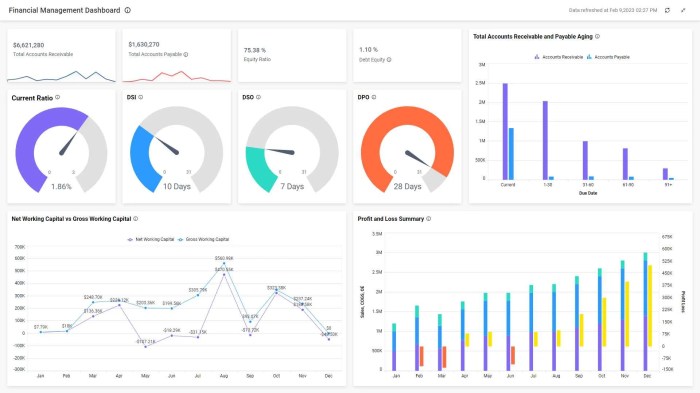

Customizable Dashboards

- Look for platforms that provide customizable dashboards, allowing you to tailor the interface to display the specific data and metrics that are most relevant to your needs.

- Customizable dashboards enhance data analysis by providing a clear and focused view of the information that matters most to you.

Advanced Analytical Tools

- Platforms with advanced analytical tools, such as data visualization capabilities and predictive analytics, can help you uncover insights and trends within the data.

- These tools enhance decision-making by providing deeper insights into the data, allowing you to make more informed choices.

Integration with Third-Party Applications

- Consider platforms that offer integration with third-party applications, such as accounting software or CRM systems, to streamline data management processes.

- Integration with third-party applications enhances data analysis by allowing you to consolidate data from multiple sources for a comprehensive view.

Security Measures in Real-Time Financial Data Tracking Platforms

Ensuring the security of financial data is paramount in real-time tracking platforms. With the increasing threats of cyber attacks and data breaches, leading platforms implement robust security measures to protect sensitive information.

Encryption Protocols

One of the key security measures employed by top platforms is encryption. This involves encoding data to make it unreadable to unauthorized users. By using strong encryption algorithms, platforms ensure that financial data remains secure during transmission and storage.

Multi-Factor Authentication

Another important security feature is multi-factor authentication. This requires users to provide more than one form of verification, such as a password and a unique code sent to their mobile device. By adding an extra layer of security, platforms can prevent unauthorized access to financial data.

Regular Security Audits

Leading platforms conduct regular security audits to identify and address any vulnerabilities in their systems. By testing for potential weaknesses and implementing necessary updates, platforms can stay ahead of emerging threats and ensure the protection of financial data.

Examples of Security Breaches

There have been notable security breaches in the financial industry, such as the Equifax data breach in 2017, where sensitive information of millions of customers was compromised. In response to such incidents, platforms have enhanced their security measures by implementing advanced monitoring tools, real-time threat detection, and rapid incident response protocols.

Integration Capabilities of Real-Time Financial Data Tracking Platforms

Real-time financial data tracking platforms offer seamless integration with different financial systems, allowing users to access and analyze data from multiple sources in one centralized location. This integration capability enhances efficiency, accuracy, and productivity for users.

Benefits of Seamless Integration

- Streamlined Data Access: Users can easily access data from various financial systems without the need to switch between multiple platforms.

- Improved Data Accuracy: Integration reduces manual data entry errors and ensures that the information is up-to-date and consistent across all systems.

- Enhanced Decision-Making: By having all financial data in one place, users can make informed decisions quickly and effectively.

- Time and Cost Savings: Integration eliminates the need for manual data consolidation, saving time and reducing operational costs.

Examples of Successful Integrations

One example of successful integration is the seamless connection between real-time financial data tracking platforms and accounting software. This integration allows users to automatically sync financial data, such as transactions and invoices, between the two systems, ensuring accurate and real-time reporting.

Another example is the integration between real-time market data providers and investment tracking platforms. This integration enables investors to track market trends and make investment decisions based on real-time data, leading to improved portfolio performance and profitability.

Customization Options Available on Top Platforms

Customization plays a crucial role in enhancing the user experience when it comes to real-time financial data tracking platforms. Leading platforms offer a variety of customization options to cater to specific user needs and preferences.

Personalized Dashboard Settings

One of the key customization options available on top platforms is the ability to personalize dashboard settings. Users can choose which financial data metrics and charts they want to see prominently displayed on their dashboard, allowing them to focus on what matters most to them.

Alerts and Notifications Customization

Users can also customize alerts and notifications based on their preferences. They can set thresholds for specific financial indicators and receive notifications when those thresholds are met, ensuring that they stay informed about important market movements.

Portfolio Customization

Another important customization option is the ability to personalize portfolio views. Users can choose how they want to organize and display their investment portfolios, making it easier to track performance and make informed decisions.

Color and Layout Customization

Top platforms also offer options for color and layout customization, allowing users to create a visually appealing and user-friendly interface. By choosing colors and layouts that suit their preferences, users can make the platform their own.

Pricing Models of Real-Time Financial Data Tracking Platforms

When it comes to choosing a real-time financial data tracking platform, understanding the pricing models is crucial. Different platforms offer various pricing structures based on multiple factors. Let's delve into the details to help businesses make informed decisions.

Comparison of Pricing Structures

- Some platforms offer subscription-based pricing, where businesses pay a monthly or annual fee for access to real-time financial data.

- Other platforms may charge based on the volume of data or the number of users accessing the platform.

- Freemium models are also prevalent, allowing users to access basic features for free but requiring payment for advanced functionalities.

Factors Influencing Pricing

- The depth and breadth of real-time financial data available on the platform can significantly impact pricing. Platforms offering extensive data coverage may charge higher fees.

- Integration capabilities with other tools and systems can also influence pricing. Platforms that seamlessly integrate with popular software may have higher price points.

- Customization options, such as personalized dashboards and alerts, can lead to tiered pricing structures where businesses pay based on the level of customization desired.

Choosing the Most Cost-Effective Option

- Before selecting a real-time financial data tracking platform, businesses should assess their specific needs and budget constraints.

- Compare pricing structures across different platforms and evaluate the value proposition of each in relation to the cost.

- Consider scalability and future growth potential when determining the cost-effectiveness of a platform to ensure it can accommodate evolving business requirements.

Final Wrap-Up

In conclusion, the landscape of real-time financial data tracking platforms offers a myriad of opportunities for businesses to optimize their data analysis and decision-making processes. With a strong emphasis on security, integration, customization, and pricing models, these platforms pave the way for enhanced efficiency and strategic insights in the financial realm.

FAQ

How secure are the top platforms for real-time financial data tracking?

The top platforms prioritize data security by employing robust security protocols to safeguard sensitive financial information.

What factors influence the pricing models of these platforms?

The pricing structures are influenced by the scope of features offered, level of customization, and the target user base of the platform.

Can users expect seamless integration with different financial systems?

Yes, these platforms are designed to seamlessly integrate with various financial systems, enhancing the overall user experience.