Decentralized Platforms and the Future of Market Transparency sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. As we delve into the world of decentralized platforms and their impact on market transparency, a new era of innovation and transparency unfolds before us.

Exploring the key concepts and real-world examples will shed light on the transformative potential of these platforms in revolutionizing market dynamics.

Overview of Decentralized Platforms

Decentralized platforms play a crucial role in enhancing market transparency by removing the need for intermediaries and providing a direct peer-to-peer network for transactions. This shift towards decentralization ensures trust and security through consensus mechanisms like blockchain technology.

Examples of Popular Decentralized Platforms

- Ethereum: Known for its smart contract capabilities, Ethereum allows users to create decentralized applications (dApps) without relying on a central authority.

- Uniswap: A decentralized exchange that enables users to trade cryptocurrencies directly with each other, eliminating the need for a middleman.

- Filecoin: Utilizes decentralized storage solutions, allowing users to rent out their unused storage space to others securely.

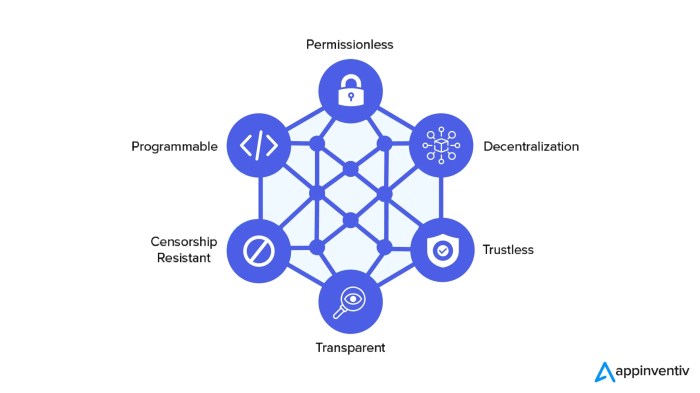

Key Features of Decentralized Platforms

- Transparency: All transactions are recorded on a public ledger, ensuring visibility and accountability for all users.

- Security: Decentralized platforms are less vulnerable to hacking attacks due to their distributed nature and encryption protocols.

- Censorship Resistance: By operating without a central authority, decentralized platforms are resistant to censorship and manipulation.

- Autonomy: Users have full control over their assets and data without the need for approval from a central entity.

Importance of Market Transparency

Market transparency plays a crucial role in financial systems by providing investors and stakeholders with access to accurate and timely information. This transparency helps ensure fair and efficient markets, promotes trust among participants, and reduces the likelihood of fraud or manipulation.

Enhanced Transparency in Decentralized Platforms

Decentralized platforms, such as blockchain-based systems, offer enhanced market transparency compared to traditional centralized systems. These platforms utilize distributed ledgers that record transactions in a transparent and immutable manner, accessible to all participants. This transparency eliminates the need for intermediaries and central authorities, reducing the risk of fraud and enhancing trust in the system.

- Blockchain technology ensures that all transactions are recorded in a tamper-proof manner, creating a transparent audit trail that can be verified by anyone.

- Smart contracts on decentralized platforms automatically execute agreements based on predefined conditions, ensuring transparency and reducing the potential for disputes.

- Decentralized exchanges allow for peer-to-peer trading without the need for a central authority, providing direct access to market information and reducing the risk of market manipulation.

Real-World Examples of Improved Market Transparency

Real-world examples demonstrate how improved market transparency benefits investors and stakeholders. For instance, in the supply chain industry, blockchain technology enables transparent tracking of products from the source to the end consumer, reducing counterfeiting and ensuring product authenticity. In the financial sector, decentralized platforms offer real-time access to trading data, enabling investors to make informed decisions based on accurate and up-to-date information.

- The use of blockchain in voting systems increases transparency and security, ensuring that votes are recorded accurately and cannot be tampered with.

- Decentralized finance (DeFi) platforms provide transparent and automated lending and borrowing processes, eliminating the need for traditional banks and reducing the cost of financial services for users.

- Tokenization of assets on blockchain platforms allows for fractional ownership and increased liquidity, opening up investment opportunities to a wider range of investors and enhancing market transparency.

Role of Blockchain Technology

Blockchain technology plays a crucial role in enabling decentralized platforms by providing a secure and transparent framework for conducting transactions. It revolutionizes the way data is stored and shared, offering a decentralized and immutable ledger that enhances trust among participants in the market

Enhanced Security and Trust

- Blockchain technology utilizes cryptographic techniques to secure transactions, making it nearly impossible for unauthorized parties to alter data.

- The decentralized nature of blockchain ensures that there is no single point of failure, reducing the risk of cyber attacks and fraud.

- Smart contracts, powered by blockchain, automate and enforce agreements without the need for intermediaries, further enhancing security and trust in transactions.

Transparency in Market Transactions

- Blockchain provides a transparent and tamper-proof record of all transactions, allowing participants to trace the history of assets or products back to their source.

- By eliminating the need for intermediaries, blockchain reduces the complexity and costs associated with traditional centralized systems, increasing transparency in market transactions.

- Decentralized platforms built on blockchain technology enable peer-to-peer transactions, fostering direct interactions between buyers and sellers with enhanced transparency.

Future Applications of Blockchain Technology

- Blockchain technology has the potential to revolutionize supply chain management by providing real-time visibility into the movement of goods, ensuring authenticity and transparency.

- In the financial sector, blockchain can streamline processes such as cross-border payments, ensuring faster and more cost-effective transactions with increased transparency.

- Blockchain-based voting systems can enhance the security and transparency of electoral processes, reducing the risk of fraud and manipulation.

Challenges and Opportunities

Decentralized platforms face various challenges in maintaining market transparency, which can hinder their overall effectiveness. However, these challenges also present opportunities for innovation and growth to overcome transparency issues and improve the functioning of decentralized platforms.

Potential Challenges Faced by Decentralized Platforms

- Lack of Regulatory Oversight: The absence of clear regulatory frameworks can lead to uncertainty and potential misuse of decentralized platforms, affecting market transparency.

- Data Privacy Concerns: Ensuring the privacy and security of user data while maintaining transparency poses a significant challenge for decentralized platforms.

- Scalability Issues: Scaling decentralized platforms to accommodate a large number of users without compromising transparency can be a technical challenge.

Opportunities for Innovation and Growth

- Blockchain Technology Advancements: Continuous advancements in blockchain technology can provide innovative solutions to enhance market transparency on decentralized platforms.

- Smart Contracts Implementation: Utilizing smart contracts can automate processes and ensure transparency in transactions on decentralized platforms.

- Community Governance Models: Implementing community-driven governance models can enhance transparency and trust among users on decentralized platforms.

Impact of Regulatory Frameworks

- Regulatory Clarity: Clear and supportive regulatory frameworks can promote the development and adoption of decentralized platforms, fostering market transparency.

- Compliance Challenges: Adhering to regulatory requirements may pose challenges for decentralized platforms, impacting their ability to maintain transparency.

- Global Regulatory Variations: Differing regulatory approaches across regions can influence the development and adoption of decentralized platforms for market transparency.

Final Review

In conclusion, the discussion on Decentralized Platforms and the Future of Market Transparency underscores the crucial role these platforms play in reshaping traditional market structures. With a focus on blockchain technology, enhanced transparency, and emerging opportunities, the future looks promising for market participants seeking a more open and equitable market environment.

FAQ Summary

How do decentralized platforms ensure market transparency?

Decentralized platforms leverage blockchain technology to provide immutable and transparent records of transactions, ensuring trust and accountability in market interactions.

What are some challenges faced by decentralized platforms in maintaining market transparency?

One challenge is regulatory compliance, as navigating evolving legal frameworks can pose obstacles to transparent operations on decentralized platforms.

How do decentralized platforms differ from centralized counterparts in terms of market transparency?

Decentralized platforms operate without a central authority, promoting transparency through peer-to-peer interactions and eliminating single points of control susceptible to manipulation.