Platform-Driven Market Analytics for Retail Investors sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. In today's fast-paced investment landscape, utilizing platforms for market analytics has become essential for retail investors seeking to make informed decisions and stay ahead of the curve.

As we delve deeper into the realm of platform-driven market analytics for retail investors, we uncover a world of possibilities and opportunities that can transform the way individuals engage with the financial markets.

Introduction to Platform-Driven Market Analytics for Retail Investors

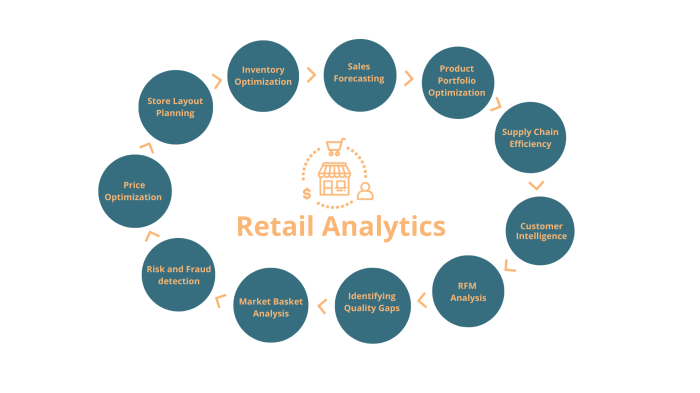

Platform-driven market analytics refer to the use of online platforms or tools that provide retail investors with data, insights, and analysis to make informed investment decisions. These platforms leverage technology to gather, analyze, and present market information in a user-friendly manner.

The significance of using platforms for market analytics by retail investors lies in the accessibility and democratization of information. Retail investors can access real-time data, research reports, and trends conveniently through these platforms, empowering them to make better investment choices.

Examples of Popular Platforms for Market Analytics

- Bloomberg Terminal: A comprehensive platform offering financial data, news, and analytics for retail investors to stay updated on market trends.

- Yahoo Finance: A user-friendly platform providing stock quotes, news, and portfolio management tools for retail investors to track their investments.

- TradingView: A social network for traders and investors offering advanced charting tools, technical analysis, and community insights for market analytics.

Benefits of Platform-Driven Market Analytics for Retail Investors

Platform-driven market analytics offer numerous advantages for retail investors compared to traditional methods. By leveraging these platforms, retail investors can make more informed decisions when it comes to investing their money.

Access to Real-Time Data

One of the key benefits of using platform-driven market analytics is the access to real-time data. Retail investors can stay updated on market trends, stock prices, and news instantly, allowing them to make timely decisions for their investments.

Customized Investment Strategies

Platforms offer the ability to create customized investment strategies based on individual goals and risk tolerance. Retail investors can tailor their approach to suit their preferences, whether they are looking for long-term growth or short-term gains.

Data Visualization Tools

Many platforms provide data visualization tools that make it easier for retail investors to interpret complex market data. Charts, graphs, and other visual aids help investors analyze trends and patterns more effectively, leading to more informed investment decisions.

Educational Resources

Platform-driven market analytics often come with educational resources such as tutorials, webinars, and articles to help retail investors enhance their financial knowledge. This empowers investors to make smarter choices and build a more robust investment portfolio.

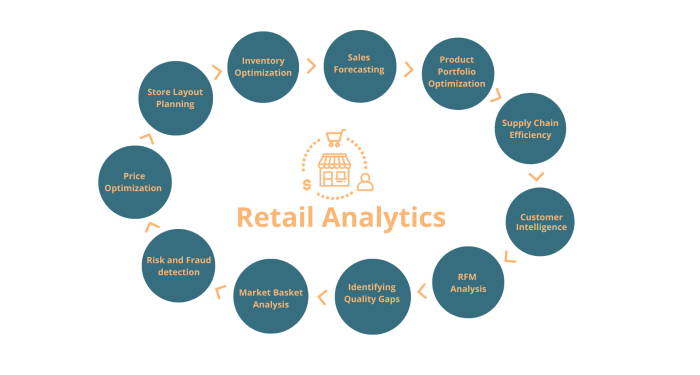

Features and Tools Offered by Platforms for Market Analytics

Platforms for market analytics offer a wide range of features and tools to help retail investors in analyzing market trends and making informed decisions.

Common Features and Tools:

- Real-time Market Data: Platforms provide access to real-time data on stock prices, market indices, and other relevant financial information.

- Technical Analysis Tools: Retail investors can use tools like charts, graphs, and technical indicators to analyze price movements and identify potential trends.

- Research Reports: Platforms may offer research reports from financial analysts to provide insights into specific companies or sectors.

- Watchlists and Alerts: Users can create watchlists of stocks they are interested in and set up alerts for price changes or news updates.

How These Features Help Retail Investors:

By utilizing these features and tools, retail investors can stay informed about market developments, identify investment opportunities, and make well-informed decisions based on data-driven analysis.

Comparison of Platforms:

| Platform | Unique Offerings |

|---|---|

| Platform A | Offers customizable dashboards for personalized data visualization. |

| Platform B | Provides social sentiment analysis tools for gauging market sentiment. |

| Platform C | Includes backtesting capabilities for testing trading strategies. |

Strategies for Effective Utilization of Platform-Driven Market Analytics

Effective utilization of platform-driven market analytics is crucial for retail investors to make informed investment decisions and maximize returns. By following best practices and leveraging the tools provided by these platforms, investors can gain valuable insights into market trends and opportunities.

Here are some strategies to help retail investors make the most out of market analytics platforms:

Interpreting Data and Insights

- Understand the key metrics: Familiarize yourself with the different data points and indicators provided by the platform, such as price trends, volume, moving averages, and volatility.

- Identify patterns and correlations: Look for patterns in the data that can help you predict future market movements. Analyze correlations between different assets to diversify your portfolio effectively.

- Utilize technical analysis: Use tools like charts, graphs, and technical indicators to identify entry and exit points for your trades.

- Stay updated: Regularly monitor market news and updates to contextualize the data provided by the platform and make timely investment decisions.

Customizing Platform Usage

- Set personalized alerts: Configure alerts for specific events or price levels to stay informed about market developments that align with your investment strategy.

- Create watchlists: Organize assets of interest into watchlists to track their performance and spot opportunities for potential investments.

- Adjust risk parameters: Tailor risk management settings on the platform according to your risk tolerance and investment goals to protect your capital effectively.

- Utilize demo accounts: Practice using the platform's features and tools in a risk-free environment through demo accounts before implementing strategies with real funds.

Last Recap

In conclusion, Platform-Driven Market Analytics for Retail Investors opens doors to a new era of data-driven decision-making in the realm of investing. By harnessing the power of platforms and cutting-edge tools, retail investors can navigate the complexities of the market with confidence and precision, unlocking a world of potential for financial growth and prosperity.

Top FAQs

What is the significance of using platforms for market analytics by retail investors?

Platforms offer retail investors access to real-time data, advanced analytics tools, and insights that can enhance their decision-making process and overall investment strategy.

How can retail investors leverage platforms for better decision-making in investing?

By utilizing platforms, retail investors can analyze market trends, track their investments, and receive personalized recommendations tailored to their financial goals.

What are some specific benefits that retail investors can gain from using platform-driven market analytics?

Retail investors can benefit from improved portfolio management, risk assessment, diversified investment options, and enhanced market insights through platform-driven market analytics.

How can retail investors interpret data and insights obtained from market analytics platforms for investment decisions?

Retail investors can interpret data by understanding key metrics, trends, and patterns to make informed decisions, adjust their investment strategy, and capitalize on market opportunities.